2012 stock picks

in work...

2011 is almost gone and it was not so kind for biotech investment. The approximate gain will be modest this time i.e. 15-20 %. It's time to plan for 2012 revenge ideas.

"The old friend is better than two new ones"

So, let us remember good biotechs with bright products that were delayed by FDA CRL in 2011 and have PDUFA in 2011-12.

1) ALXA - PDUFA Feb. 04, 2012

2) PLX - PDUFA Feb. 01, 2012

3) AMLN - PDUFA Jan. 28, 2012

4) NEOP - PDUFA June 10, 2012

I already have ALXA and AMLN and will buy PLX soon. Each stock at least 5-10% of portfolio value, because the probability of FDA approval for all 3 is very high now.

BTW Nov. 12, 2011 is PDUFA for PSDV/ALIM (second attempt after CRL) so it's better have them both.

4) TSPT PDUFA Nov. 27, 2011 for Intermezzo(R) for sleep aid for middle-of-the-night awakenings - second attempt after CRL - low risk, will buy soon

5) INCY PDUFA Dec. 3, 2011 - ruxolitinib for myelofibrosis (MF) - first attempt, medium risk, will buy it soon

6) AIS PDUFA Dec. 8, 2011 for Anturol® - a novel treatment for the delivery of the anticholinergic drug, oxybutynin which is pending FDA approval for the management of overactive bladder - first attempt, medium risk, will buy it

About 17% of women and 16% men over 18 years old have overactive bladder (OAB). OAB is estimated to affect more than 22 million people in Europe, and more than 33 million in the United States.

Antares Pharma has said that its Anturol gel met its primary endpoint of reduction in urinary incontinence episodes for both doses studied (56mg daily or 84mg daily) in a Phase 3 study evaluating patients with overactive bladder (OAB).

Anturol gel Phase 3 trial conducted under a special protocol assessment (SPA) with FDA, was a double blind, randomised, parallel placebo-controlled multi-center study which evaluated the efficacy and safety of Anturol in patients with overactive bladder.

Anturol gel Phase 3 study primary objective was to show that daily treatment of an 84mg or 56mg dose of Oxybutynin applied in the ATDTM gel technology for 12 weeks was superior to placebo for the relief of OAB symptoms.

Whereas, the secondary endpoints of the study are changes from baseline in average daily urinary frequency, void volume, patient perceptions, as well as safety and tolerability including skin irritation.

Antares Pharma said that the 84mg dose provided positive results for the secondary end points of urinary frequency and volume while the 56mg dose did not reach statistical significance.

Additionally, Anturol which uses the proprietary ATD Gel technology was well tolerated in the study.

ANTUROL was found to be well-tolerated at all doses with a reduced adverse event profile in comparison to those reported in both oral and adhesive patch formulations. Results also showed clear evidence of dose proportionality and linear pharmacokinetics among the tested doses. At the intermediate dose, ANTUROL Gel provided oxybutynin average and peak plasma levels comparable to those previously published for the transdermal patch delivery system.

Typically, the gel is administered daily, and is effective on a sustained release basis over approximately a 24-hour period of time.

Economic Costs

The cost of OAB is 12.6 billion in year 2000 dollars. $9.1 and $3.5 billion, respectively, was incurred by community and institutional residents.

7) BPAX PDUFA Nov. 14, 2011 Bio-T-Gel (testosterone gel) for male hypogonadism, licensed to Teva Pharmaceuticals - first attempt, medium risk. If Bio-T-Gel approved BPAX pps will spike >30-50% or even more. The current pps $2.30 is a safe entry for this biotech. Updated to neutral or sell (read BPAX page)

BioSante will receive certain milestone payments and royalties upon commercialization. The current U.S. market for male testosterone products is over $1.2 billion

Typically, a man’s testosterone level is considered low if it’s below a level of approximately 300 ng/dL. Low testosterone can be caused by a signaling problem that occurs between the brain and the testes that causes the production of testosterone to drop below normal. Low testosterone also can occur when the body can’t make normal levels of testosterone and can lead to a medical condition known as hypogonadism that has many symptoms including fatigue, decreased energy, reduced sexual desire and depressed mood.

It is estimated that low testosterone affects more than 4 to 5 million men in the U.S. Common symptoms include reduced sex drive, decreased energy, loss of body hair or reduced shaving, and depressed mood. There is no cure for hypogonadism. It is a medical condition that usually requires ongoing treatment.

BPAX has LibiGel® (transdermal testosterone gel) in Phase III clinical development by BioSante under a U.S. Food and Drug Administration (FDA) SPA (Special Protocol Assessment) for the treatment of female sexual dysfunction (FSD).

"In a Phase II trial, LibiGel significantly increased the number of satisfying sexual events in surgically menopausal women suffering from FSD by 238 percent versus baseline (p<0.0001); this increase also was significant versus placebo (p<0.05). In this study, the effective dose of LibiGel produced testosterone blood levels within the normal range for pre-menopausal women and had a safety profile similar to that observed in the placebo group. In addition, no serious adverse events and no discontinuations due to adverse events occurred in any subject receiving LibiGel. The Phase II clinical trial was a double-blind, placebo-controlled trial, conducted in the United States, in surgically menopausal women distressed by their low sexual desire and activity."

238% vs. baseline (p<0.0001)... The randomness can't generate such high effect, so these results must be repeated in phase III trial. BioSante’s objective is to submit the LibiGel NDA for a product launch in 2012.

BioSante reported that with 3,656 women enrolled and over 4,800 women-years of exposure in its LibiGel Phase III cardiovascular and breast cancer safety study, there have been 29 adjudicated cardiovascular (CV) events, with a lower than anticipated event rate of approximately 0.60 percent. In the same population of subjects, there have been 17 breast cancers reported, a rate of approximately 0.35 percent, which is in line with the ages of the subjects enrolled in the study. The primary safety analysis will be conducted and reported in the third quarter of 2012. This analysis will allow us to submit the LibiGel new drug application (NDA) in the fourth quarter of 2012, as planned.”

An approval of Bio-T-Gel (testosterone gel) will increase the probability of LibiGel® approval and vice versa.

First time PDUFA 2012:

1) AFFY - PDUFA March 27, 2012 for their lead product peginesatide (Hematide) - too risky

On June 21, 2010, Affymax, Inc. (NASDAQ:AFFY) and Takeda Global Research & Development Center, Inc., a wholly owned subsidiary of Takeda Pharmaceutical Company Limited, released data from the Phase III Hematide program that introduced concerns about the drug's safety profile. The trials met their main goal but showed a higher rate of cardiovascular events, including death and stroke, in Hematide patients who were suffering from chronic renal failure but were not on dialysis. The trials found that safety risks for Hematide were similar to those of current drugs for kidney dialysis patients. On June 21, 2010, the price of Affymax stock dropped as much as 69 percent to as low as $7.12. Shares of Affymax, Inc. continued to decline from its 52weekHigh of $26.20 per share to as low as $6.63 per share, and traded recently at $6.70 per share.

2) MAPP - PDUFA March 26, 2012 for LEVADEX® orally inhaled migraine drug for the potential acute treatment of migraine - medium risk, we will see ALXA approval first

3) CORT - PDUFA Feb. 17, 2012 Corlux for Cushing's Syndrome - first attempt (no FDA Advisory Committee Meeting) - medium risk, will buy it but may be only for "run up" gain

CORLUX, also known as mifepristone, is the lead compound in Corcept's development portfolio. It is a small molecule which blocks the cortisol, or GR-II receptor. By blocking the receptor, CORLUX reduces the receptor's activation by cortisol.

CORT has only one phase III 50-patient open-label study in endogenous Cushing's Syndrome patients who were not eligible, failed or relapsed from surgery. Cushing's Syndrome has a five-year 50% mortality rate if left untreated.

Statistically significant improvement in the primary endpoint was achieved for both groups: with 60% and 38% responding in the glucose intolerant group and hypertensive group, respectively. Statistically significant benefit was also achieved in the key secondary endpoint of global clinical improvement, with 87% of patients responding. An initial review of safety data indicates that CORLUX was well tolerated by Cushing’s Syndrome patients in this Phase 3 study.

And there is no FDA approved therapy available to Cushing’s Syndrome patients patients.

CORT pps is $3 and funds are accumulating this biotech (Institutional Ownership: 34.6%).

2012 shorts

VRUS - 2012 should be a final year of this biotech Ponzi. It seems like that entire VRUS chart was designed by some special trade software (let call it “Chart Architect”). The goal was to show an infinite growth that is not affected by any market fluctuations. All short attempts were immediately crashed by this software and VRUS management permanently releases some phenomenal news about new oral “interferon-free” HCV panacea tested on 20-30 patients with very rare GT2-3 HCV that easy curable.

But yesterday Abbott said in presentation slides that PILOT AND CO-PILOT interim results for its Hepatitis C virus are "unprecedented and very promising." The company said others in the field have shown interferon-free cure is possible (its combination therapy does not include tough-to-tolerate interferon, which causes flu-like symptoms).

The study found the hepatitis C virus was reduced to undetectable levels in 41 of 42 patients after they were treated with Abbott’s drug combination for three months. At six months, nine of the 10 patients still being monitored showed no sign of the virus. The drugmaker told investors it would be able to get its drug combination approved and to market by 2015.

11.21.11 by BiotechInvest

GILD bought VRUS... Unpredictable, crazy and suicide action for Gilead. If oral HCV combination is worse than VRTX IV HCV drug GILD will be crashed.

Any way it was a terrible event for my portfolio and recovery will take a long time. Well, may be shorting GILD will help it.

02.17.12 by BiotechInvest

Well, at least I know now that I was 100 % right about VRUS HCV drug: GILD bought a complete fake and lost $10B. VRUS drug is active but only when patients take it i.e. suppress virus replication when "nucs" in blood. When drug wash out virus start to repcicate and patients have experienced viral relapse.

Since "nucs" are dangerous for liver HCV patients can't have this medication for long time because it will kill them.

Congrats to GILD CEO - $10B for a fake should be included to 2011 The Guinness Book of Records.

So, Big Pharma, next time when you will going to buy another fake just have some independent consulting. Because your brainless R&D can't evaluate any technologies. VRUS just designed a good game to fool GILD and inspire them to buy a fake before it was too late (sure that now VRUS pps must be in $10-20 range if it still exist).

12.16.11 by BiotechInvest

Well, it seems like that GILD is going to pay $11B for fake HCV drug.

Indeed, this acquisition should be included in Guinness World Records as most expensive one when $11B dollars were paid for nothing i.e. for fake and toxic HCV drug that was tested on 40 patients in phase II trial.

VRUS HCV drug is toxic for liver (just translated VRUS citation of "laboratory abnormalities associated with liver function."

Adam F. wrote: "Analysts rushed to defend Inhibitex, pulling out their medicinal chemistry textbooks to demonstrate that while INX-189 was similar in some respects to Pharmasset's PSI-938, the two drugs also have structural differences.

For hepatitis C investors, Friday was clearly a day to regret sleeping through your college chemistry classes.

Here's what JMP Securities analyst Liisa Bayko had to say to clients about INX-189:

For hepatitis C investors, Friday was clearly a day to regret sleeping through your college chemistry classes. Here's what JMP Securities analyst Liisa Bayko had to say to clients about INX-189:

"In our view, it is important to note that PSI-938 has a different active species (2-fluoro guanosine triphosphate) than INX-189 (2-methyl guanosine triphosphate) and that the compounds are not similar outside of the guanosine base - looking at the compounds as a whole, we believeINX-189 is more structurally similar to PSI-7977 than PSI-938. We also note that there are guanosine drugs marketed such as acyclovir, and therefore we do not believe that guanosine is the reason for the PSI-938 toxicity."

Adam F. has very interesting nomination "The Worst Biotech CEO of 2011"

Well if we have a nomination for "The Worst Biotech analyst of 2011" the award should go to Liisa Bayko.

Because the structure is not significant for PSI-938, INH-189 or PSI-7977. They are all nucleotide analogs ("nucs") and they are all interfere with RNA metabolism required for viral replication. But all of them may substantially incorporated into cell liver DNA and in such way have the inhibiting effects on DNA synthesis, as well as having other effects on gene-expression.

Liver cells are dividing fast and any interference with DNA synthesis and translation will induce the "laboratory abnormalities associated with liver function."

The second award should go to Deutstch Bank analyst Robyn Karnauskas that held a call for clients Friday morning with an Inhibitex executive and a medicinal chemist who has worked on INX-189 and is familiar with other hepatitis C drugs.

"If you compare the activated forms of each (which happens pretty fast) the 2 structures are much much closer: specifically, varying only in that 938 has a F at C-2' in and 189 has a OH (F is a chemical isostere of OH)...The 938 result does not necessarily mean the same will hold for 189, but as I see it, it increases odds," said one buy-side analyst, referring to a side-by-side diagram of the chemical structures of INX-198 and PSI-939.

Honestly, I never read something more stupid...

Conclusions: GILD/VRUS deal needs a criminal investigation. Especially if GILG will not cancel this stupid VRUS acquisition. BTW they can do it easy now.

JAZZ - this company based on selling a single drug - Xyrem, a Jazz Pharmaceuticals drug used to treat excessive sleepiness. The JAZZ chart is also infinitely growing from <$1 to $50 during last couple years. Everybody knows that JAZZ growing sales are based only on permanent Xyrem price increasing from (effective dose range is 6–9 grams per night, which equates to $2,762 (6g) to $4,143 (9g) per month or $33,144 to $50,000 per year).

$460 for 1 g of this simplest chemical compound? Even aspirin (that is more complicate to synthesize) price is

$1-3 per 1 g.

Well, may be Xyrem is very effective drug and help narcoleptics to avoid excessive sleepness? May be, but some patients that taking Xyrem fall asleep forever and JAZZ hide it (never submit reports on serious adverse drug events).

In a warning letter dated Oct. 11, the FDA said Jazz failed to submit 74 serious, unexpected adverse drug reports associated with the company's narcolepsy drug Xyrem during a seven-year period. Among the reports, at least 10 of them involved a patient death.

Well the narcolepsy is a sleep disorder but patients never die from it. Simple calculation said that JAZZ sold Xyrem to 4000-5000 patients in USA and 1-2 patients died each year because of Xyrem. May be not so many...

Will this news crash JAZZ in 2012? Unlikely

JAZZ has Xyrem monopoly from FDA i.e. ODE (ORPHAN DRUG EXCLUSIVITY). And Exclusivity Expiration for Xyrem is Nov 18, 2012

On November 22, 2010, Jazz Pharmaceuticals, Inc. (the "Company") filed a lawsuit in the United States District Court for the District of New Jersey against Roxane Laboratories, Inc. ("Roxane") for infringement of all of the Company's patents for Xyrem' (sodium oxybate oral solution) currently listed in the Approved Drug Products with Therapeutic Equivalence Evaluations (the "Orange Book"). The lawsuit concerns an Abbreviated New Drug Application ("ANDA") filed by Roxane with the U.S. Food and Drug Administration ("FDA") seeking FDA approval to market a generic version of Xyrem prior to the expiration of the identified patents.

In accordance with the Hatch-Waxman Act, as a result of having filed a timely lawsuit against Roxane, FDA approval of Roxane's ANDA will be stayed until the earlier of 1) 30 months from the Company's October 18, 2010 receipt of Roxane's Paragraph IV certification notice or 2) a District Court decision finding that the identified patents are invalid, unenforceable or not infringed.

30 months from October 18, 2010 will be April 18, 2013. Or earlier if District Court decision finding that the identified patents are invalid, unenforceable or not infringed.

Xyrem itself is not protected by any JAZZ patents for drug. It's protected only by the "distribution patent"

Did somebody read this distribution patent? Just read it for fun. In 2005 they patented the algorithm of Xyrem distribution and they are thinking that nobody will create something better. This algorithm become obsolete long time ago. Sure that Boehringer Inghelheim and Roxane have it and will prove at the court that they have the much better version of Xyrem distribution system.

And read what JAZZ CEO said:

"...it is hard to imagine that another company without access to our database could ensure in fact that they were not shipping drug to a patient who was also receiving Jazz Pharmaceutical Xyrem"

It seems like that this guy has some problem with imagination...

So, entire JAZZ strategy in the court is based on "distribution algorithm" for Xyrem? And JAZZ want to persuade the

judge that only they can distribute Xyrem to patients? Are you kidding me?

When to short JAZZ? May be the best strategy is to short it at price spike (Third Quarter 2011 Results Conference Call on November 1).

Recently Jazz Pharmaceuticals Inc. (JAZZ) said it would merge with privately held Irish specialty drug maker Azur Pharma Ltd. in an all-stock deal. Again some trick is here:

"Upon completion of the merger, shareholders of the current Jazz Pharmaceuticals would own just under 80% of the combined company, and Azur Pharma shareholders would hold the rest. Current Jazz Pharma shareholders would receive one ordinary share in the combined company for each current Jazz common share they own.

The combined company is expected to have a capitalization of approximately 60 million fully diluted shares.

Now JAZZ has Shares Out. 41.7M so Azur Pharma shareholders would get 18.3M shares at $40 pps i.e. $732M

Will they keep these 18.3M shares with risk to lose >50% when Xyrem become generic and JAZZ sales will drop 2-3 times to $15M per quarter or $45M per year?

In simple words this merger is a 30% stock dilution of JAZZ stock. Azur shareholders can sell it right after merger completion.

Besides shorting JAZZ it's possible to buy puts contracts.

JAZZ Jan 19 2013 30.0 Put 455 Days to Expiration

Bid 4.10 Ask 5.50 Bid/Ask Size 50X50 Last 3.40

Even at $20 pps in Jan 2013 these puts could generate 200% profit.

ITMN - InterMune Announces Launch of Esbriet® (pirfenidone) in Germany - Launches in other European countries to follow in 2012

With the price of one year's treatment expected to be around $21000 (€15000) a year per patient and an estimated 30,000-35,000 new cases of IPF are diagnosed in Europe each year annual sales may reach $630M

So, may be it's better buy ITMN as all biotech analysts are persuading investors?

Not sure...

Firstly, InterMune is obliged to conduct routine safety surveillance of spontaneous adverse drug reactions (ADRs) and to conduct a PASS (Post Authorisation Safety Study) in the form of a registry to collect and monitor ADRs in patients who have been prescribed Esbriet. The PASS Registry is expected to enroll 1,000 patients over two years and to follow these patients for a similar period.

ITMN drug was rejected by FDA because it failed to show any efficacy in ine from 2 phase III trials and now ITMN enrolles patients in third phase III

Estimated Enrollment: 500

Study Start Date: June 2011

Estimated Primary Completion Date: December 2012 (Final data collection date for primary outcome measure)

If this trial failed FDA will never approve Esbriet in USA and Europe may think about to stop Esbriet sale.

One more:

Since 2008, Esbriet has been marketed in Japan as Pirespa® by Shionogi & Co. Ltd.

The NHI price of Shionogi's Pirespa (pirfenidone) 200mg tablets for the treatment of idiopathic pulmonary fibrosis, was set at 676.40 yen with a 25.0% premium (an average operating profit ratio of 19.2% X 130%) for innovativeness because of its effectiveness in intractable disease. Pirespa was designated an orphan drug. It was licensed from Marnac of the USA and KDL in Tokyo. First and the 10th year peak sales are expected to reach 160 million yen and 2.35 billion yen, respectively. Since 1$ = ¥84 first and the 10th year peak sales are expected to reach 1.9 million dollars and 28 million dollars, respectively.

$28M in peak for Japan with population is 127,076,183?

Even if Europe population is 3 time bigger than Japan i.e. 400M sales should be expected to reach $120M per year.

It's not so impressive as $630M

And what is about competitors in IPF treatment? May be ITMN has a monopoly for next 10-15 years?

Again it's not true:

Phase II clinical trial results, published today in the New England Journal of Medicine, for Boehringer Ingelheim’s investigational tyrosine kinase inhibitor (TKI) BIBF 1120* showed a positive trend in reducing lung function decline in patients with idiopathic pulmonary fibrosis (IPF). 1 IPF is a chronic, progressive, severely debilitating lung disease with a high mortality rate, for which there are limited treatment options. 2

In the study, known as TOMORROW (To I mprove Pulm ona ry Fib rosis with BIBF 1120), patients treated with 150 mg of BIBF 1120* twice daily demonstrated a 68 percent reduction in the rate of forced vital capacity (FVC) decline compared to placebo (0.06 litres per year in the BIBF 1120* 150 mg bid arm vs. 0.19 litres per year in the placebo arm). FVC is the volume of air that is expelled into a spirometer following maximum inhalation. FVC decline is a part of the usual examinations conducted in IPF patients. 3 Lung function is scientifically accepted for assessment of treatment effects in IPF patients. 3 Patients treated with 150 mg of BIBF 1120* twice daily also had a lower incidence of acute exacerbations, defined as sudden deterioration of clinical status, compared with placebo. 1 Acute exacerbations are associated with rapid disease progression, severe abrupt decline in FVC and high mortality.

In addition, treatment with 150 mg BIBF 1120* twice daily resulted in a small decrease in the SGRQ score (St George’s Respiratory Questionnaire) as compared with an increase in placebo (-0.66 vs. 5.46; p= 0.007). 1,6 SGRQ scores measure the impact of quality of life, with higher scores – as well as increasing scores – signalling greater impairment.

ITMN phase III results: "The pooled analysis of Categorical FVC Change showed that 30% fewer patients experienced a 10% or greater decrease in FVC at week 72 in the pirfenidone group than in the placebo group. This magnitude of decline is considered clinically meaningful as a 10% decline in percent predicted FVC has been shown in multiple studies to be an independent predictor of mortality in patients with IPF. In addition, 40% more patients in the pirfenidone group did not experience a decline in percent predicted FVC at week 72 versus baseline compared to those who received placebo."

BI drug: 68 percent reduction in the rate of forced vital capacity (FVC) vs. ITMN drug: 30% fewer patients experienced a 10% or greater decrease in FVC

“People who suffer from IPF are in great need of a safe and effective treatment to preserve lung function so they can maintain physical activity and reduce the impact on their independence for as long as possible,” said Luca Richeldi, MD, PhD, lead study author and director of the Research Centre for Rare Lung Diseases, University of Modena and Reggio Emilia, Modena, Italy. “The positive trends in slowing the decline in lung function over time, reducing the incidence of acute exacerbations and improving the quality of life with BIBF 1120* are a promising proof of concept.”

BIBF 1120* received orphan-drug designation from the U.S. Food and Drug Administration in June 2011 and by the Ministry of Health, Labour and Welfare of Japan in September 2011, acknowledging the fact that there is a high unmet clinical need for this drug and that it has a high development potential.

Wait a minute but Japan already has Pirespa® for IPF. Why Japan Ministry of Health is acknowledging the fact that there is a high unmet clinical need for this drug?

The answer may be very simple: Pirespa® is not effective for IPF.

“The promising results of the phase II clinical trial for BIBF 1120* in IPF give us the confidence to continue assessing the compound’s potential for improving the lives of patients affected by this very serious disease in phase III clinical trials,” said Professor Klaus Dugi, MD, Corporate Senior Vice President Medicine at Boehringer Ingelheim Headquarters. “With a strong heritage in respiratory medicine, Boehringer Ingelheim remains committed to identifying a safe and effective treatment for IPF to help bridge the unmet therapeutic need for the thousands of people suffering from this fatal disease.”

Two pivotal phase III clinical trials are currently underway enrolling 970 patients in 20 countries. The first patients entered the trials in April and May 2011, respectively."

Estimated Enrollment: 485

Study Start Date: May 2011

Estimated Primary Completion Date: January 2014 (Final data collection date for primary outcome measure)

When to short ITMN? Big holders control ITMN pps (Institutional Ownership: 97.8%) and most of them bought it at $35-40. They know that ITMN game is over and they want to sell it. Question is how to sell 60M of doomed company to other funds? And when?

At any positive news for ITMN like "good Launch of Esbriet® (pirfenidone) in Germany"

What is the possible ITMN pps if BI drug BIBF 1120 win the phase III trials in 2014? May be less $3 because ITMN has nothing more in drug portfolio.

November 03, 2011 update:

"InterMune began selling Esbriet in Germany in September, and it reported $118,000 in revenue."

I'm not sure that this is positive news for ITMN.

"Dan Welch, Chairman, Chief Executive Officer and President of InterMune said, "The third quarter was highlighted by the launch of Esbriet in Germany at the Annual Congress of the European Respiratory Society in late September, which provided an outstanding forum to roll out the Esbriet launch campaign. We are very pleased by the high level of awareness of and interest in Esbriet among German pulmonologists and the demand for Esbriet in Germany during the six weeks since launch is meeting our expectations.

Only ugly liar can say this.

"Esbriet is a drug designed to treat a terminal lung disease called idiopathic pulmonary fibrosis, or IPF. IFP causes inflammation and scarring of the lung, making it harder for patients to breathe."

Half of IPF sufferers die within three years of diagnosis

5/100,000 individuals in the United States develop IPF per year.

If German total population 82 million there should be at least 12,000 IPF patients and IPF kills about 5,000 patients per year.

The cost of IPF treatment is $100-120/patient/day i.e. German pulmonologists should prescribe at least 10,000X120X30=$36M per month. Ok, 1,000X120X30=$3.6M per month. Why this absurd $118,000 in revenue?

Why they are not doing it and in such way "killing" their IPF patients?

May be answer is simple: they know that Esbriet will not help them.

12.16.11 by BiotechInvest

ITMN is crashed already in 2011. 2012 pps should be below $5

Microcap picks for 2012

Every biotech investor "dreams a dream" that once he will discovered a real hidden biotech gem with pps $0.20 buy 30-50k shares and just wait 3-5 years when this gem will start to shine like a "crazy diamond" and pps jump to $10.

Everybody read the stories likely "you can practically get started with as little as $1000 and can still make 1 million in 2 years or less"

Of course, it's a bu..sh..t.

I get started with $100k in 2009 and if I make $500k in 2012 i.e. in 3 years it will be very good story.

Now I have >$100k in 5 microcaps:

Buy pps Sell price

1) AEN ADEONA PHARMACEUTICALS now Synthetic Biologics, Inc.(SYN) $0.58 $3.00

2) PYMX POLYMEDIX $0.59 $3.00

3) PSID POSITIVEID CORP $0.20 $1.00

4) NNVC NANOVIRICIDES $0.98 $5.00

EMIS EMISPHERE TECHNOLOGIES $1.82 $9.00 failed in phase III trial excluded from list

5) INO INOVIO PHARMACEUTICALS $0.65 $3.30

6) ALXA Alexza Pharmaceuticals Inc $1.25 $6.00

7) BHRT BIOHEART $0.06 $0.60

And I will keep this "magnificent six" before it will make me $500k in next 3-4 years. I will sell each stock only when it make 500%.

May be I just "dream a dream" but time will tell.

Since EMIS was excluded I will add ALXA to my list. And since there was no a "magnificent six" only a "The Magnificent Seven" I added BHRT to the list.

So, have 7 microcaps: new approach to cure Alzheimer Disease, new antibiotic, new method of blood sugar measure, new antiviral drug, new delivery method of DNA-based vaccines, new method of lung drug delivery, stem cells. Will keep them next 3-4 years (may sell sometimes "temp" if need money for short-term investment).

.

2011 is almost gone and it was not so kind for biotech investment. The approximate gain will be modest this time i.e. 15-20 %. It's time to plan for 2012 revenge ideas.

"The old friend is better than two new ones"

So, let us remember good biotechs with bright products that were delayed by FDA CRL in 2011 and have PDUFA in 2011-12.

1) ALXA - PDUFA Feb. 04, 2012

2) PLX - PDUFA Feb. 01, 2012

3) AMLN - PDUFA Jan. 28, 2012

4) NEOP - PDUFA June 10, 2012

I already have ALXA and AMLN and will buy PLX soon. Each stock at least 5-10% of portfolio value, because the probability of FDA approval for all 3 is very high now.

BTW Nov. 12, 2011 is PDUFA for PSDV/ALIM (second attempt after CRL) so it's better have them both.

4) TSPT PDUFA Nov. 27, 2011 for Intermezzo(R) for sleep aid for middle-of-the-night awakenings - second attempt after CRL - low risk, will buy soon

5) INCY PDUFA Dec. 3, 2011 - ruxolitinib for myelofibrosis (MF) - first attempt, medium risk, will buy it soon

6) AIS PDUFA Dec. 8, 2011 for Anturol® - a novel treatment for the delivery of the anticholinergic drug, oxybutynin which is pending FDA approval for the management of overactive bladder - first attempt, medium risk, will buy it

About 17% of women and 16% men over 18 years old have overactive bladder (OAB). OAB is estimated to affect more than 22 million people in Europe, and more than 33 million in the United States.

Antares Pharma has said that its Anturol gel met its primary endpoint of reduction in urinary incontinence episodes for both doses studied (56mg daily or 84mg daily) in a Phase 3 study evaluating patients with overactive bladder (OAB).

Anturol gel Phase 3 trial conducted under a special protocol assessment (SPA) with FDA, was a double blind, randomised, parallel placebo-controlled multi-center study which evaluated the efficacy and safety of Anturol in patients with overactive bladder.

Anturol gel Phase 3 study primary objective was to show that daily treatment of an 84mg or 56mg dose of Oxybutynin applied in the ATDTM gel technology for 12 weeks was superior to placebo for the relief of OAB symptoms.

Whereas, the secondary endpoints of the study are changes from baseline in average daily urinary frequency, void volume, patient perceptions, as well as safety and tolerability including skin irritation.

Antares Pharma said that the 84mg dose provided positive results for the secondary end points of urinary frequency and volume while the 56mg dose did not reach statistical significance.

Additionally, Anturol which uses the proprietary ATD Gel technology was well tolerated in the study.

ANTUROL was found to be well-tolerated at all doses with a reduced adverse event profile in comparison to those reported in both oral and adhesive patch formulations. Results also showed clear evidence of dose proportionality and linear pharmacokinetics among the tested doses. At the intermediate dose, ANTUROL Gel provided oxybutynin average and peak plasma levels comparable to those previously published for the transdermal patch delivery system.

Typically, the gel is administered daily, and is effective on a sustained release basis over approximately a 24-hour period of time.

Economic Costs

The cost of OAB is 12.6 billion in year 2000 dollars. $9.1 and $3.5 billion, respectively, was incurred by community and institutional residents.

7) BPAX PDUFA Nov. 14, 2011 Bio-T-Gel (testosterone gel) for male hypogonadism, licensed to Teva Pharmaceuticals - first attempt, medium risk. If Bio-T-Gel approved BPAX pps will spike >30-50% or even more. The current pps $2.30 is a safe entry for this biotech. Updated to neutral or sell (read BPAX page)

BioSante will receive certain milestone payments and royalties upon commercialization. The current U.S. market for male testosterone products is over $1.2 billion

Typically, a man’s testosterone level is considered low if it’s below a level of approximately 300 ng/dL. Low testosterone can be caused by a signaling problem that occurs between the brain and the testes that causes the production of testosterone to drop below normal. Low testosterone also can occur when the body can’t make normal levels of testosterone and can lead to a medical condition known as hypogonadism that has many symptoms including fatigue, decreased energy, reduced sexual desire and depressed mood.

It is estimated that low testosterone affects more than 4 to 5 million men in the U.S. Common symptoms include reduced sex drive, decreased energy, loss of body hair or reduced shaving, and depressed mood. There is no cure for hypogonadism. It is a medical condition that usually requires ongoing treatment.

BPAX has LibiGel® (transdermal testosterone gel) in Phase III clinical development by BioSante under a U.S. Food and Drug Administration (FDA) SPA (Special Protocol Assessment) for the treatment of female sexual dysfunction (FSD).

"In a Phase II trial, LibiGel significantly increased the number of satisfying sexual events in surgically menopausal women suffering from FSD by 238 percent versus baseline (p<0.0001); this increase also was significant versus placebo (p<0.05). In this study, the effective dose of LibiGel produced testosterone blood levels within the normal range for pre-menopausal women and had a safety profile similar to that observed in the placebo group. In addition, no serious adverse events and no discontinuations due to adverse events occurred in any subject receiving LibiGel. The Phase II clinical trial was a double-blind, placebo-controlled trial, conducted in the United States, in surgically menopausal women distressed by their low sexual desire and activity."

238% vs. baseline (p<0.0001)... The randomness can't generate such high effect, so these results must be repeated in phase III trial. BioSante’s objective is to submit the LibiGel NDA for a product launch in 2012.

BioSante reported that with 3,656 women enrolled and over 4,800 women-years of exposure in its LibiGel Phase III cardiovascular and breast cancer safety study, there have been 29 adjudicated cardiovascular (CV) events, with a lower than anticipated event rate of approximately 0.60 percent. In the same population of subjects, there have been 17 breast cancers reported, a rate of approximately 0.35 percent, which is in line with the ages of the subjects enrolled in the study. The primary safety analysis will be conducted and reported in the third quarter of 2012. This analysis will allow us to submit the LibiGel new drug application (NDA) in the fourth quarter of 2012, as planned.”

An approval of Bio-T-Gel (testosterone gel) will increase the probability of LibiGel® approval and vice versa.

First time PDUFA 2012:

1) AFFY - PDUFA March 27, 2012 for their lead product peginesatide (Hematide) - too risky

On June 21, 2010, Affymax, Inc. (NASDAQ:AFFY) and Takeda Global Research & Development Center, Inc., a wholly owned subsidiary of Takeda Pharmaceutical Company Limited, released data from the Phase III Hematide program that introduced concerns about the drug's safety profile. The trials met their main goal but showed a higher rate of cardiovascular events, including death and stroke, in Hematide patients who were suffering from chronic renal failure but were not on dialysis. The trials found that safety risks for Hematide were similar to those of current drugs for kidney dialysis patients. On June 21, 2010, the price of Affymax stock dropped as much as 69 percent to as low as $7.12. Shares of Affymax, Inc. continued to decline from its 52weekHigh of $26.20 per share to as low as $6.63 per share, and traded recently at $6.70 per share.

2) MAPP - PDUFA March 26, 2012 for LEVADEX® orally inhaled migraine drug for the potential acute treatment of migraine - medium risk, we will see ALXA approval first

3) CORT - PDUFA Feb. 17, 2012 Corlux for Cushing's Syndrome - first attempt (no FDA Advisory Committee Meeting) - medium risk, will buy it but may be only for "run up" gain

CORLUX, also known as mifepristone, is the lead compound in Corcept's development portfolio. It is a small molecule which blocks the cortisol, or GR-II receptor. By blocking the receptor, CORLUX reduces the receptor's activation by cortisol.

CORT has only one phase III 50-patient open-label study in endogenous Cushing's Syndrome patients who were not eligible, failed or relapsed from surgery. Cushing's Syndrome has a five-year 50% mortality rate if left untreated.

Statistically significant improvement in the primary endpoint was achieved for both groups: with 60% and 38% responding in the glucose intolerant group and hypertensive group, respectively. Statistically significant benefit was also achieved in the key secondary endpoint of global clinical improvement, with 87% of patients responding. An initial review of safety data indicates that CORLUX was well tolerated by Cushing’s Syndrome patients in this Phase 3 study.

And there is no FDA approved therapy available to Cushing’s Syndrome patients patients.

CORT pps is $3 and funds are accumulating this biotech (Institutional Ownership: 34.6%).

2012 shorts

VRUS - 2012 should be a final year of this biotech Ponzi. It seems like that entire VRUS chart was designed by some special trade software (let call it “Chart Architect”). The goal was to show an infinite growth that is not affected by any market fluctuations. All short attempts were immediately crashed by this software and VRUS management permanently releases some phenomenal news about new oral “interferon-free” HCV panacea tested on 20-30 patients with very rare GT2-3 HCV that easy curable.

But yesterday Abbott said in presentation slides that PILOT AND CO-PILOT interim results for its Hepatitis C virus are "unprecedented and very promising." The company said others in the field have shown interferon-free cure is possible (its combination therapy does not include tough-to-tolerate interferon, which causes flu-like symptoms).

The study found the hepatitis C virus was reduced to undetectable levels in 41 of 42 patients after they were treated with Abbott’s drug combination for three months. At six months, nine of the 10 patients still being monitored showed no sign of the virus. The drugmaker told investors it would be able to get its drug combination approved and to market by 2015.

11.21.11 by BiotechInvest

GILD bought VRUS... Unpredictable, crazy and suicide action for Gilead. If oral HCV combination is worse than VRTX IV HCV drug GILD will be crashed.

Any way it was a terrible event for my portfolio and recovery will take a long time. Well, may be shorting GILD will help it.

02.17.12 by BiotechInvest

Well, at least I know now that I was 100 % right about VRUS HCV drug: GILD bought a complete fake and lost $10B. VRUS drug is active but only when patients take it i.e. suppress virus replication when "nucs" in blood. When drug wash out virus start to repcicate and patients have experienced viral relapse.

Since "nucs" are dangerous for liver HCV patients can't have this medication for long time because it will kill them.

Congrats to GILD CEO - $10B for a fake should be included to 2011 The Guinness Book of Records.

So, Big Pharma, next time when you will going to buy another fake just have some independent consulting. Because your brainless R&D can't evaluate any technologies. VRUS just designed a good game to fool GILD and inspire them to buy a fake before it was too late (sure that now VRUS pps must be in $10-20 range if it still exist).

12.16.11 by BiotechInvest

Well, it seems like that GILD is going to pay $11B for fake HCV drug.

Indeed, this acquisition should be included in Guinness World Records as most expensive one when $11B dollars were paid for nothing i.e. for fake and toxic HCV drug that was tested on 40 patients in phase II trial.

VRUS HCV drug is toxic for liver (just translated VRUS citation of "laboratory abnormalities associated with liver function."

Adam F. wrote: "Analysts rushed to defend Inhibitex, pulling out their medicinal chemistry textbooks to demonstrate that while INX-189 was similar in some respects to Pharmasset's PSI-938, the two drugs also have structural differences.

For hepatitis C investors, Friday was clearly a day to regret sleeping through your college chemistry classes.

Here's what JMP Securities analyst Liisa Bayko had to say to clients about INX-189:

For hepatitis C investors, Friday was clearly a day to regret sleeping through your college chemistry classes. Here's what JMP Securities analyst Liisa Bayko had to say to clients about INX-189:

"In our view, it is important to note that PSI-938 has a different active species (2-fluoro guanosine triphosphate) than INX-189 (2-methyl guanosine triphosphate) and that the compounds are not similar outside of the guanosine base - looking at the compounds as a whole, we believeINX-189 is more structurally similar to PSI-7977 than PSI-938. We also note that there are guanosine drugs marketed such as acyclovir, and therefore we do not believe that guanosine is the reason for the PSI-938 toxicity."

Adam F. has very interesting nomination "The Worst Biotech CEO of 2011"

Well if we have a nomination for "The Worst Biotech analyst of 2011" the award should go to Liisa Bayko.

Because the structure is not significant for PSI-938, INH-189 or PSI-7977. They are all nucleotide analogs ("nucs") and they are all interfere with RNA metabolism required for viral replication. But all of them may substantially incorporated into cell liver DNA and in such way have the inhibiting effects on DNA synthesis, as well as having other effects on gene-expression.

Liver cells are dividing fast and any interference with DNA synthesis and translation will induce the "laboratory abnormalities associated with liver function."

The second award should go to Deutstch Bank analyst Robyn Karnauskas that held a call for clients Friday morning with an Inhibitex executive and a medicinal chemist who has worked on INX-189 and is familiar with other hepatitis C drugs.

"If you compare the activated forms of each (which happens pretty fast) the 2 structures are much much closer: specifically, varying only in that 938 has a F at C-2' in and 189 has a OH (F is a chemical isostere of OH)...The 938 result does not necessarily mean the same will hold for 189, but as I see it, it increases odds," said one buy-side analyst, referring to a side-by-side diagram of the chemical structures of INX-198 and PSI-939.

Honestly, I never read something more stupid...

Conclusions: GILD/VRUS deal needs a criminal investigation. Especially if GILG will not cancel this stupid VRUS acquisition. BTW they can do it easy now.

JAZZ - this company based on selling a single drug - Xyrem, a Jazz Pharmaceuticals drug used to treat excessive sleepiness. The JAZZ chart is also infinitely growing from <$1 to $50 during last couple years. Everybody knows that JAZZ growing sales are based only on permanent Xyrem price increasing from (effective dose range is 6–9 grams per night, which equates to $2,762 (6g) to $4,143 (9g) per month or $33,144 to $50,000 per year).

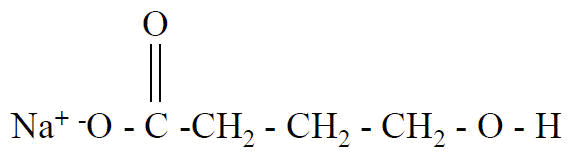

$460 for 1 g of this simplest chemical compound? Even aspirin (that is more complicate to synthesize) price is

$1-3 per 1 g.

Well, may be Xyrem is very effective drug and help narcoleptics to avoid excessive sleepness? May be, but some patients that taking Xyrem fall asleep forever and JAZZ hide it (never submit reports on serious adverse drug events).

In a warning letter dated Oct. 11, the FDA said Jazz failed to submit 74 serious, unexpected adverse drug reports associated with the company's narcolepsy drug Xyrem during a seven-year period. Among the reports, at least 10 of them involved a patient death.

Well the narcolepsy is a sleep disorder but patients never die from it. Simple calculation said that JAZZ sold Xyrem to 4000-5000 patients in USA and 1-2 patients died each year because of Xyrem. May be not so many...

Will this news crash JAZZ in 2012? Unlikely

JAZZ has Xyrem monopoly from FDA i.e. ODE (ORPHAN DRUG EXCLUSIVITY). And Exclusivity Expiration for Xyrem is Nov 18, 2012

On November 22, 2010, Jazz Pharmaceuticals, Inc. (the "Company") filed a lawsuit in the United States District Court for the District of New Jersey against Roxane Laboratories, Inc. ("Roxane") for infringement of all of the Company's patents for Xyrem' (sodium oxybate oral solution) currently listed in the Approved Drug Products with Therapeutic Equivalence Evaluations (the "Orange Book"). The lawsuit concerns an Abbreviated New Drug Application ("ANDA") filed by Roxane with the U.S. Food and Drug Administration ("FDA") seeking FDA approval to market a generic version of Xyrem prior to the expiration of the identified patents.

In accordance with the Hatch-Waxman Act, as a result of having filed a timely lawsuit against Roxane, FDA approval of Roxane's ANDA will be stayed until the earlier of 1) 30 months from the Company's October 18, 2010 receipt of Roxane's Paragraph IV certification notice or 2) a District Court decision finding that the identified patents are invalid, unenforceable or not infringed.

30 months from October 18, 2010 will be April 18, 2013. Or earlier if District Court decision finding that the identified patents are invalid, unenforceable or not infringed.

Xyrem itself is not protected by any JAZZ patents for drug. It's protected only by the "distribution patent"

Did somebody read this distribution patent? Just read it for fun. In 2005 they patented the algorithm of Xyrem distribution and they are thinking that nobody will create something better. This algorithm become obsolete long time ago. Sure that Boehringer Inghelheim and Roxane have it and will prove at the court that they have the much better version of Xyrem distribution system.

And read what JAZZ CEO said:

"...it is hard to imagine that another company without access to our database could ensure in fact that they were not shipping drug to a patient who was also receiving Jazz Pharmaceutical Xyrem"

It seems like that this guy has some problem with imagination...

So, entire JAZZ strategy in the court is based on "distribution algorithm" for Xyrem? And JAZZ want to persuade the

judge that only they can distribute Xyrem to patients? Are you kidding me?

When to short JAZZ? May be the best strategy is to short it at price spike (Third Quarter 2011 Results Conference Call on November 1).

Recently Jazz Pharmaceuticals Inc. (JAZZ) said it would merge with privately held Irish specialty drug maker Azur Pharma Ltd. in an all-stock deal. Again some trick is here:

"Upon completion of the merger, shareholders of the current Jazz Pharmaceuticals would own just under 80% of the combined company, and Azur Pharma shareholders would hold the rest. Current Jazz Pharma shareholders would receive one ordinary share in the combined company for each current Jazz common share they own.

The combined company is expected to have a capitalization of approximately 60 million fully diluted shares.

Now JAZZ has Shares Out. 41.7M so Azur Pharma shareholders would get 18.3M shares at $40 pps i.e. $732M

Will they keep these 18.3M shares with risk to lose >50% when Xyrem become generic and JAZZ sales will drop 2-3 times to $15M per quarter or $45M per year?

In simple words this merger is a 30% stock dilution of JAZZ stock. Azur shareholders can sell it right after merger completion.

Besides shorting JAZZ it's possible to buy puts contracts.

JAZZ Jan 19 2013 30.0 Put 455 Days to Expiration

Bid 4.10 Ask 5.50 Bid/Ask Size 50X50 Last 3.40

Even at $20 pps in Jan 2013 these puts could generate 200% profit.

ITMN - InterMune Announces Launch of Esbriet® (pirfenidone) in Germany - Launches in other European countries to follow in 2012

With the price of one year's treatment expected to be around $21000 (€15000) a year per patient and an estimated 30,000-35,000 new cases of IPF are diagnosed in Europe each year annual sales may reach $630M

So, may be it's better buy ITMN as all biotech analysts are persuading investors?

Not sure...

Firstly, InterMune is obliged to conduct routine safety surveillance of spontaneous adverse drug reactions (ADRs) and to conduct a PASS (Post Authorisation Safety Study) in the form of a registry to collect and monitor ADRs in patients who have been prescribed Esbriet. The PASS Registry is expected to enroll 1,000 patients over two years and to follow these patients for a similar period.

ITMN drug was rejected by FDA because it failed to show any efficacy in ine from 2 phase III trials and now ITMN enrolles patients in third phase III

Estimated Enrollment: 500

Study Start Date: June 2011

Estimated Primary Completion Date: December 2012 (Final data collection date for primary outcome measure)

If this trial failed FDA will never approve Esbriet in USA and Europe may think about to stop Esbriet sale.

One more:

Since 2008, Esbriet has been marketed in Japan as Pirespa® by Shionogi & Co. Ltd.

The NHI price of Shionogi's Pirespa (pirfenidone) 200mg tablets for the treatment of idiopathic pulmonary fibrosis, was set at 676.40 yen with a 25.0% premium (an average operating profit ratio of 19.2% X 130%) for innovativeness because of its effectiveness in intractable disease. Pirespa was designated an orphan drug. It was licensed from Marnac of the USA and KDL in Tokyo. First and the 10th year peak sales are expected to reach 160 million yen and 2.35 billion yen, respectively. Since 1$ = ¥84 first and the 10th year peak sales are expected to reach 1.9 million dollars and 28 million dollars, respectively.

$28M in peak for Japan with population is 127,076,183?

Even if Europe population is 3 time bigger than Japan i.e. 400M sales should be expected to reach $120M per year.

It's not so impressive as $630M

And what is about competitors in IPF treatment? May be ITMN has a monopoly for next 10-15 years?

Again it's not true:

Phase II clinical trial results, published today in the New England Journal of Medicine, for Boehringer Ingelheim’s investigational tyrosine kinase inhibitor (TKI) BIBF 1120* showed a positive trend in reducing lung function decline in patients with idiopathic pulmonary fibrosis (IPF). 1 IPF is a chronic, progressive, severely debilitating lung disease with a high mortality rate, for which there are limited treatment options. 2

In the study, known as TOMORROW (To I mprove Pulm ona ry Fib rosis with BIBF 1120), patients treated with 150 mg of BIBF 1120* twice daily demonstrated a 68 percent reduction in the rate of forced vital capacity (FVC) decline compared to placebo (0.06 litres per year in the BIBF 1120* 150 mg bid arm vs. 0.19 litres per year in the placebo arm). FVC is the volume of air that is expelled into a spirometer following maximum inhalation. FVC decline is a part of the usual examinations conducted in IPF patients. 3 Lung function is scientifically accepted for assessment of treatment effects in IPF patients. 3 Patients treated with 150 mg of BIBF 1120* twice daily also had a lower incidence of acute exacerbations, defined as sudden deterioration of clinical status, compared with placebo. 1 Acute exacerbations are associated with rapid disease progression, severe abrupt decline in FVC and high mortality.

In addition, treatment with 150 mg BIBF 1120* twice daily resulted in a small decrease in the SGRQ score (St George’s Respiratory Questionnaire) as compared with an increase in placebo (-0.66 vs. 5.46; p= 0.007). 1,6 SGRQ scores measure the impact of quality of life, with higher scores – as well as increasing scores – signalling greater impairment.

ITMN phase III results: "The pooled analysis of Categorical FVC Change showed that 30% fewer patients experienced a 10% or greater decrease in FVC at week 72 in the pirfenidone group than in the placebo group. This magnitude of decline is considered clinically meaningful as a 10% decline in percent predicted FVC has been shown in multiple studies to be an independent predictor of mortality in patients with IPF. In addition, 40% more patients in the pirfenidone group did not experience a decline in percent predicted FVC at week 72 versus baseline compared to those who received placebo."

BI drug: 68 percent reduction in the rate of forced vital capacity (FVC) vs. ITMN drug: 30% fewer patients experienced a 10% or greater decrease in FVC

“People who suffer from IPF are in great need of a safe and effective treatment to preserve lung function so they can maintain physical activity and reduce the impact on their independence for as long as possible,” said Luca Richeldi, MD, PhD, lead study author and director of the Research Centre for Rare Lung Diseases, University of Modena and Reggio Emilia, Modena, Italy. “The positive trends in slowing the decline in lung function over time, reducing the incidence of acute exacerbations and improving the quality of life with BIBF 1120* are a promising proof of concept.”

BIBF 1120* received orphan-drug designation from the U.S. Food and Drug Administration in June 2011 and by the Ministry of Health, Labour and Welfare of Japan in September 2011, acknowledging the fact that there is a high unmet clinical need for this drug and that it has a high development potential.

Wait a minute but Japan already has Pirespa® for IPF. Why Japan Ministry of Health is acknowledging the fact that there is a high unmet clinical need for this drug?

The answer may be very simple: Pirespa® is not effective for IPF.

“The promising results of the phase II clinical trial for BIBF 1120* in IPF give us the confidence to continue assessing the compound’s potential for improving the lives of patients affected by this very serious disease in phase III clinical trials,” said Professor Klaus Dugi, MD, Corporate Senior Vice President Medicine at Boehringer Ingelheim Headquarters. “With a strong heritage in respiratory medicine, Boehringer Ingelheim remains committed to identifying a safe and effective treatment for IPF to help bridge the unmet therapeutic need for the thousands of people suffering from this fatal disease.”

Two pivotal phase III clinical trials are currently underway enrolling 970 patients in 20 countries. The first patients entered the trials in April and May 2011, respectively."

Estimated Enrollment: 485

Study Start Date: May 2011

Estimated Primary Completion Date: January 2014 (Final data collection date for primary outcome measure)

When to short ITMN? Big holders control ITMN pps (Institutional Ownership: 97.8%) and most of them bought it at $35-40. They know that ITMN game is over and they want to sell it. Question is how to sell 60M of doomed company to other funds? And when?

At any positive news for ITMN like "good Launch of Esbriet® (pirfenidone) in Germany"

What is the possible ITMN pps if BI drug BIBF 1120 win the phase III trials in 2014? May be less $3 because ITMN has nothing more in drug portfolio.

November 03, 2011 update:

"InterMune began selling Esbriet in Germany in September, and it reported $118,000 in revenue."

I'm not sure that this is positive news for ITMN.

"Dan Welch, Chairman, Chief Executive Officer and President of InterMune said, "The third quarter was highlighted by the launch of Esbriet in Germany at the Annual Congress of the European Respiratory Society in late September, which provided an outstanding forum to roll out the Esbriet launch campaign. We are very pleased by the high level of awareness of and interest in Esbriet among German pulmonologists and the demand for Esbriet in Germany during the six weeks since launch is meeting our expectations.

Only ugly liar can say this.

"Esbriet is a drug designed to treat a terminal lung disease called idiopathic pulmonary fibrosis, or IPF. IFP causes inflammation and scarring of the lung, making it harder for patients to breathe."

Half of IPF sufferers die within three years of diagnosis

5/100,000 individuals in the United States develop IPF per year.

If German total population 82 million there should be at least 12,000 IPF patients and IPF kills about 5,000 patients per year.

The cost of IPF treatment is $100-120/patient/day i.e. German pulmonologists should prescribe at least 10,000X120X30=$36M per month. Ok, 1,000X120X30=$3.6M per month. Why this absurd $118,000 in revenue?

Why they are not doing it and in such way "killing" their IPF patients?

May be answer is simple: they know that Esbriet will not help them.

12.16.11 by BiotechInvest

ITMN is crashed already in 2011. 2012 pps should be below $5

Microcap picks for 2012

Every biotech investor "dreams a dream" that once he will discovered a real hidden biotech gem with pps $0.20 buy 30-50k shares and just wait 3-5 years when this gem will start to shine like a "crazy diamond" and pps jump to $10.

Everybody read the stories likely "you can practically get started with as little as $1000 and can still make 1 million in 2 years or less"

Of course, it's a bu..sh..t.

I get started with $100k in 2009 and if I make $500k in 2012 i.e. in 3 years it will be very good story.

Now I have >$100k in 5 microcaps:

Buy pps Sell price

1) AEN ADEONA PHARMACEUTICALS now Synthetic Biologics, Inc.(SYN) $0.58 $3.00

2) PYMX POLYMEDIX $0.59 $3.00

3) PSID POSITIVEID CORP $0.20 $1.00

4) NNVC NANOVIRICIDES $0.98 $5.00

EMIS EMISPHERE TECHNOLOGIES $1.82 $9.00 failed in phase III trial excluded from list

5) INO INOVIO PHARMACEUTICALS $0.65 $3.30

6) ALXA Alexza Pharmaceuticals Inc $1.25 $6.00

7) BHRT BIOHEART $0.06 $0.60

And I will keep this "magnificent six" before it will make me $500k in next 3-4 years. I will sell each stock only when it make 500%.

May be I just "dream a dream" but time will tell.

Since EMIS was excluded I will add ALXA to my list. And since there was no a "magnificent six" only a "The Magnificent Seven" I added BHRT to the list.

So, have 7 microcaps: new approach to cure Alzheimer Disease, new antibiotic, new method of blood sugar measure, new antiviral drug, new delivery method of DNA-based vaccines, new method of lung drug delivery, stem cells. Will keep them next 3-4 years (may sell sometimes "temp" if need money for short-term investment).

.